One Big Unpopular Bill

The Republican budget bill, which now heads to Trump's desk, will be the most unpopular major law in at least 30 years

Midday on Thursday, July 3, Republicans in the U.S. House of Representatives voted to approve a marquee tax cut and budget bill they’ve been trying to pass since May. Republicans in the Senate passed the same bill on Tuesday, courtesy of a tie-breaker by Vice President JD Vance, so it now goes straight to President Donald Trump's desk to become law. The signing ceremony has been scheduled for Friday afternoon, on Independence Day.

The "One Big Beautiful Bill Act" (yes, that is its official government name) is a huge package of different policies, including tax cuts for the wealthy and the largest ever yearly increase (hundreds of billions of dollars) in funding for the Pentagon, ICE, and CBP. Republicans have "paid for" those tax cuts and spending increases by making the largest ever cuts to Medicaid and government food benefits, among other programs.

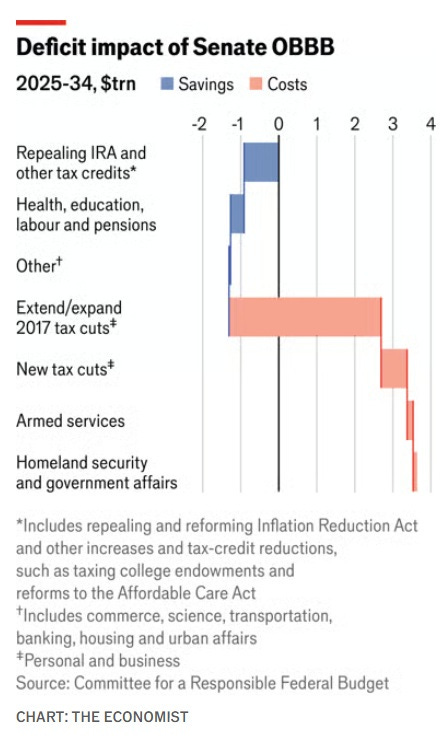

I place "paid for" in quotes because despite the claims from Trump's White House advisors, the reduction in spending on various social programs does not come close to covering the cost of the tax cuts. The Republican budget bill is a historic shifting of taxpayer money previously allocated to government assistance to the needy, to rich people, and immigration enforcement. This chart from The Economist lays out the math:

The OBBBA is also historic in another way: It is likely the most unpopular budget ever, is the second most unpopular piece of key legislation since the 1990s, and the most unpopular key law, period, over the same period. Using our Strength In Numbers/Verasight poll, we have already found that the individial provisions of the law are opposed by supermajorities of the public. But a historical comparison is also useful.

So in today's quick Chart of the Week post, let's take stock of polling on the GOP budget and compare it to polls of prior presidential priorities.

One Big Unpopular Bill

A note on sourcing: All the data I'm referencing in this piece is available publicly here. It was compiled by me, former FiveThirtyEight co-worker Mary Radcliffe, and Christopher Warshaw, Professor of Political Science at Georgetown University's McCourt School of Public Policy.

First, let's take a look at all of the polls of the One Big Beautiful Bill Act. These polls range in question wording from asking specific questions about policy tradeoffs (such as in our Strength In Numbers/Verasight poll) to straight support/opposition to the bill. All of these polls were conducted after the framework for the original bill in the House was announced in late April.

Note that support for the bill maxes out at 38%, or -15 in terms of the margin between support and opposition. The bill's net rating is generally worse the more specific a pollster gets about what it does. Net support for the bill has also trended upward since it was first introduced, as Republicans have rallied around it in support of their party leader.

Yet it is still hopelessly underwater. On average across pollsters and methods, 31% of Americans support the One Big Beautiful Bill, while 54% oppose it. That net rating of -23 is, to put it mildly, absolutely abysmal. That's true in both absolute terms (having a majority against you with just a third in support is terrible!) and comparative terms.

According to data compiled by Georgetown's Warshaw, the OBBBA is the second most unpopular piece of key legislation since 1990, and likely the most unpopular budget (I have to say "likely" because we don't have polls of every budget proposal) ever. Here are the net support/oppose numbers for a bunch of bills Warshaw has tracked over time:

According to the polls, the only bill more unpopular than this year's GOP budget bill is the 2017 Republican health care bill, which would have killed the funding mechanism for the Affordable Care Act, cut $800 billion from (basically eliminating) Medicaid, and slashed taxes on high earners.

The current GOP budget is even more unpopular than the 2008 bank bailout. That's pretty terrible! And it’s far more unpopular than the Affordable Care Act, which only squeaked by Congress to become law in 2010.

Finally, note that the top three most unpopular legislative policies/policy proposals in the past 30 years have all been introduced by the Republican Party under a Trump presidency. The president's core priorities are not designed for the average person, but for an intense base of supporters that constitutes a solid minority of Americans. This is despite Trump's claim to be representing "the will of the people" and the typical archetype attached to Trump of a populist ruler looking out for the interests of the working class and "real America." Trump may have won the popular vote, but that doesn't mean what he's doing is popular.

Support data-driven journalism!

Become a paying member of Strength In Numbers today and get exclusive posts, early access to data, and more.

Your support helps fund polling trackers, original polls, deep analysis, and data-driven journalism that cuts through the noise of today’s media landscape. Support our site and tell the world that when it comes to the news and democracy, there is strength in numbers.

Who is the GOP budget for?

One question you may have after looking at all this data: Why would Republicans pass something so unpopular? Indeed, equally perplexing is that the bill directly contradicts the Republican Party's stated policy goals.

Remember that the GOP has for decades been trying to accomplish two things. First, to get rid of most social programs and return tax dollars to the wealthy. The way this gets sold by right-leaning policymakers is that they are "reducing the tax burden" on high earners to "free up capital" and grow the economy. In reality, what that means is punishing poor people.

Here's a chart from The Economist on how the bill redistributes money from the poor to the wealthy.

This chart is good because it fits in a reasonable amount of vertical space, but I personally like mine better. It is scaled by dollars and shows you just how much money the richest people in America make under this bill. The average 0.1%-er will gain nearly $400,000 over the next ten years. People in the top 1% gain nearly 50k. Meanwhile, the average poor family will lose about $1,000 annually.

If you're a hard-core conservative, this may sound good to you. But the second stated goal of Republican tax policy since 1980 is to decrease the budget deficit. Of course, every time the GOP has been faced with the decision to increase the deficit and help their donors — in 2001, 2003, 2017, and 2025 — rather than cut spending and the deficit, they have chosen the former. Case in point: The OBBBA will increase the deficit by $4 trillion over the next decade, according to non-partisan analysts.

You might think about government taxing and spending this way: The government funds some set of services using money from an overall pie of government dollars, where those dollars come from (1) taxes and (2) debt. The OBBBA increases the size of the pie by shrinking taxes and increasing debt, while also decreasing the output of the government.

Huh?

If you're a Republican, why would you go along with this? Why vote to take on more debt, for a lower return on your tax dollars? Why would you vote to pay more for less?

The answer is that the bill is not supposed to be a rational policy at all. It's not about politics, it's about partisanship, influence, money, and power. The reality of the OBBBA is that Republicans have compromised on their principles of a small, budget-conscious state, breaking their promise to their constituents and themselves, to enrich themselves and their donors and deliver Trump a policy win. The causality here is easy to demonstrate: On Thursday morning, several Republican House representatives flipped their vote from No to Yes after getting calls from the president.

The OBBBA is not a conservative bill. It’s not even a “populist” bill. What it is, is a Trump bill.

The GOP budget lays bare how hollow the promises of Trumpism have been for the working and middle class. Trump has said he wouldn't cut entitlements, but tried to in 2017 and still entertains privatizing or rolling back Social Security. He has said he would end involvement in foreign wars, but bombed Iran (a move that is also very unpopular) and has not stopped the war in Ukraine (which he promised to do in 24 hours). His tariff policy has hurt U.S. manufacturing and caused large companies to raise prices for consumers. And through Thursday, Trump was still insisting the budget bill "would not touch" Medicaid, which is a lie.

Trump won the presidency in 2016 and 2024 by promising to help the little guy and the left-behind. But his key policies have had the opposite effect.

What America gets with the new GOP budget law will be a government welfare and tax policy that takes money away from poor people, gives it to rich people and ICE, all while exploding the deficit.

It's not hard to understand why that's unpopular. Trumpism is, at its core, a movement for the minority.

Your explanations are always so clear--thank you.

Thank you for the fact-based reporting. The Trump Administration is already engaged in a full-scale propaganda initiative to try to make this brutal bill more popular. People receiving social security received a propaganda email from the Social Security Administration last night--and the bill has not yet been signed. My understanding from what I have read on various trustworthy sites is that the bill does not remove taxes on Social Security, so a lie is being circulated, and a lie can spread much faster than truth, so that concerns me. I will paste in the contents of that email into the remainder of my post here:

"Social Security Applauds Passage of Legislation Providing Historic Tax Relief for Seniors

The Social Security Administration (SSA) is celebrating the passage of the One Big, Beautiful Bill, a landmark piece of legislation that delivers long-awaited tax relief to millions of older Americans.

The bill ensures that nearly 90% of Social Security beneficiaries will no longer pay federal income taxes on their benefits, providing meaningful and immediate relief to seniors who have spent a lifetime contributing to our nation's economy.

“This is a historic step forward for America’s seniors,” said Social Security Commissioner Frank Bisignano. “For nearly 90 years, Social Security has been a cornerstone of economic security for older Americans. By significantly reducing the tax burden on benefits, this legislation reaffirms President Trump’s promise to protect Social Security and helps ensure that seniors can better enjoy the retirement they’ve earned."

The new law includes a provision that eliminates federal income taxes on Social Security benefits for most beneficiaries, providing relief to individuals and couples. Additionally, it provides an enhanced deduction for taxpayers aged 65 and older, ensuring that retirees can keep more of what they have earned.

Social Security remains committed to providing timely, accurate information to the public and will continue working closely with federal partners to ensure beneficiaries understand how this legislation may affect them."